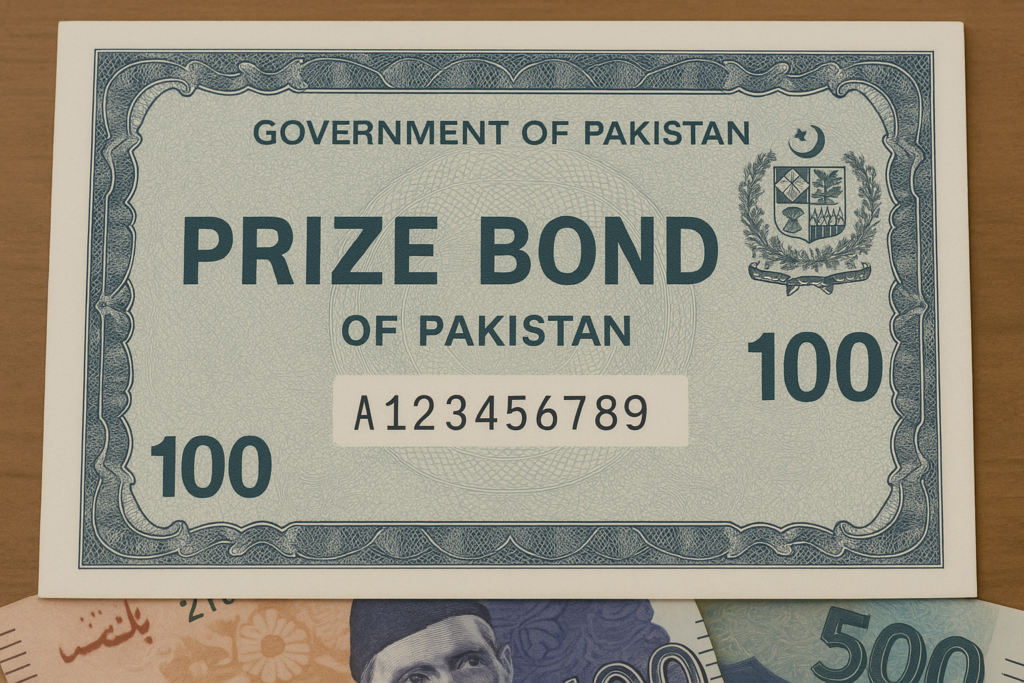

In Pakistan, Prize Bond is one of the most popular investment and savings instruments. It offers individuals a safe and secure way to save money while giving them an equal chance to win attractive prizes through government-supervised draws. Unlike other investment tools, prize bonds are interest-free and are backed by the Government of Pakistan, making them a trusted choice for millions of people.

What is a Prize Bond?

A Prize Bond is essentially a bearer-type security issued by the Government of Pakistan. Anyone can purchase a prize bond of a specific denomination without the need for registration. The key feature of prize bonds is that they are entered into regular draws, where winners are selected randomly to receive cash prizes.

The most common denominations of prize bonds available in Pakistan include:

- PKR 100

- PKR 200

- PKR 750

- PKR 1,500

- PKR 7,500

- PKR 15,000

- PKR 25,000 (Premium)

- PKR 40,000 (Premium)

How Do Prize Bond Draws Work?

The draws are conducted by the National Savings Pakistan under strict government supervision. Each denomination has its own schedule, and the results are announced quarterly. The prize structure includes one major prize, several second prizes, and thousands of smaller prizes, ensuring that participants have multiple chances of winning.

For instance, the PKR 40,000 Premium Prize Bond offers a grand prize of PKR 80 million, while even smaller denominations like PKR 200 or PKR 750 come with appealing rewards for lucky winners.

Why Are Prize Bonds Popular in Pakistan?

- Risk-Free Savings – Being government-backed, prize bonds are secure and eliminate risks associated with private investment schemes.

- Tax-Free Prizes – Winners enjoy prizes that are free from most deductions, apart from minimal withholding tax.

- Easy Liquidity – Prize bonds can be easily encashed at any bank, making them a flexible investment.

- Equal Opportunity – Every bond has an equal chance of winning, regardless of the purchase amount.

Benefits of Investing in Prize Bonds

- Safe Investment – No fear of fraud or default.

- Accessible to Everyone – Available in small denominations, making them affordable for all classes.

- Chance to Earn Big – Even a PKR 100 bond holder can win a large prize.

- No Expiry Date – Prize bonds remain valid indefinitely until encashed.

Where to Check Prize Bond Results?

The results of every draw are officially published by the National Savings Pakistan and can also be checked through newspapers, online portals, and mobile applications. Many websites update results immediately after the draw, helping investors verify if they are among the lucky winners.

Prize Bonds vs. Other Investments

While prize bonds do not provide regular returns like fixed deposits or stocks, they attract individuals who value security and the thrill of winning prizes. They are best suited for people who want to keep their savings safe while maintaining a chance of hitting a financial jackpot.

For those who want to explore more about investment opportunities, financial planning, and smart saving strategies, you can visit The Content Horizon for insightful articles and guides.

Final Thoughts

The Prize Bond system in Pakistan remains a unique blend of security, savings, and opportunity. It encourages people to save money in a safe environment while keeping alive the hope of winning life-changing prizes. Whether you are a first-time buyer or a seasoned investor, prize bonds can be an exciting part of your financial journey.

To learn more about investment tips and future-ready financial solutions, explore The Content Horizon for expert-driven insights.

Leave a Reply